In 2014, I had some funds in Canada that I wanted to invest – the CAD to USD exchange rate was too awful back then I didn’t want to convert it. However, as a non-resident of Canada, I was highly limited in what I’m able to invest in. I thought I’d take advantage of a Tax-Free Savings Account (TFSA) until I found something better to do with the money. A TFSA is similar to the ROTH IRA in that it allows for tax-free growth. So I figured I’d give it a try…that was a mistake.

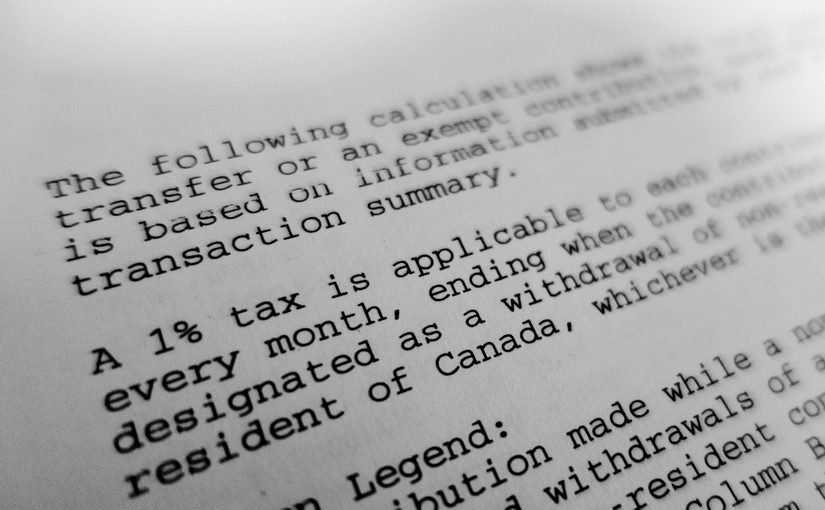

It turns out that non-residents of Canada cannot make deposits into a TFSA. When you do, a surprisingly high tax kicks into place: 1% per month on the total invested. If you leave funds in a TFSA all year, you’re paying 12% tax on it. And that’s not on the interest, it’s on the principal. Ouch! Unfortunately, I didn’t realize this – and there was no warning to me before making the investment. Luckily I invested late in the year, so the fees I had to pay were a little more than one month. No one likes receiving a surprise tax bill in the mail though!

Bottom line: unless you live in Canada, don’t put money into a TFSA.