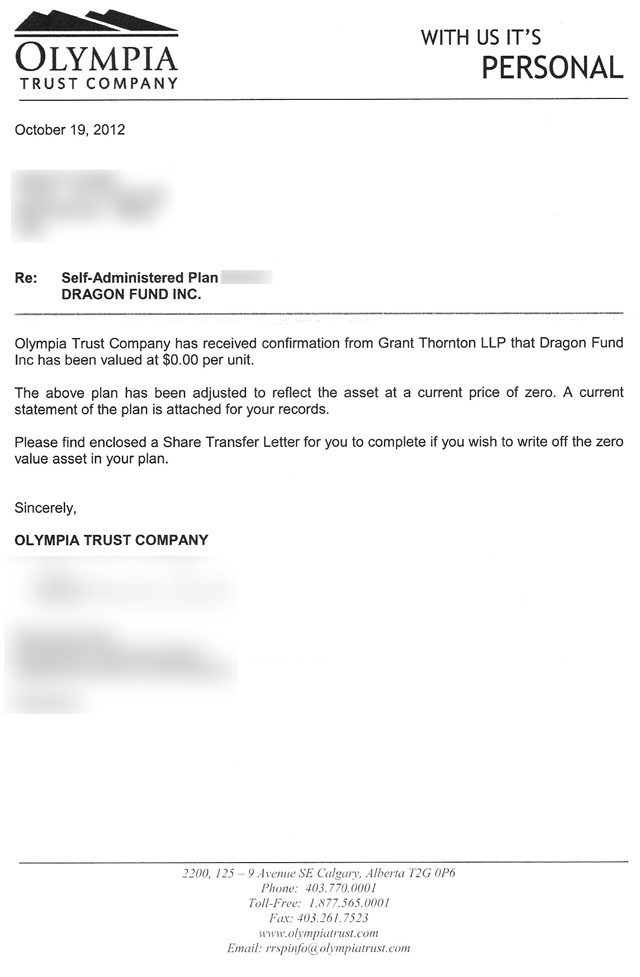

Since a few people email me every month asking if I know anything about the status of the Dragon Fund, I thought it would be helpful if I published this letter I received from Olympia Trust Company last month. It officially declares that the Dragon Fund is defunct and worthless. If you need the documents required to remove this investment from your account, please contact Olympia Trust Company at 1-877-565-0001.

Tag: investment

Dragon Fund Update, July 25th, 2011

I received this via email today. If you’re an investor with money in the Dragon Fund, here’s what’s going on (which is to say, still not much):

July 25, 2011

Dragon Fund Update

Recently Dragon Fund and the trustees of the fund have been served with an Amended Statement of Claim which has included MacLeod Dixon. This amendment has created a conflict of interest between our legal counsel (MacLeod Dixon), ourselves and the fund. MacLeod Dixon is no longer able to represent the fund as this is a conflict of interest.

New legal representation for Mike Arnold and Tina Zowtuk has recommend we resign as trustees . Due to the Amended Statement of Claim the new legal counsel can represent us personally but not the fund.

We are currently asking for individuals to put their name forward to take on the trustee role of the Dragon Fund LP. If we are unable to replace the trustees internally the fund will have to appoint an external trustee.

If you are interested in becoming a trustee please forward your contact information.

Regards

Mike Arnold

Tina Zowtuk

Avenue Commercial Castleridge LP Investment Corp. Annual General Meeting Notes

Today I attended the Avenue Commercial Castleridge LP Investment Corp. Annual General Meeting and finally learned about the status of our troubled Concrete Equities investment. There’s some bad news, and some good news. Overall though, it was net-positive: the bottom line is that there’s some debt to deal with (the vultures want their pound of flesh), but we have full ownership of our property, are cash-flow positive, and things are looking up in terms of us eventually getting back on track for the cash disbursements we all signed up for. I took as many notes as I could; here they are in point form:

- Presented by Steven Butt, General Partner, Avenue Commercial

- Very positive on this particular building

- They were given millions of pages of documents by Ernst & Young; hard drives. Five months of work to process, several hundreds of thousands of pages scanned

- They’re not going to go back and look at all the documents – they’re moving forward

- We now have financial statements (hooray!)

- T-5013 tax forms are available

- Castleridge: 8.25 acres of property, 74,000 square feet of leasable space

- Building constructed in 19991 and in good condition, but the overall property needs some work. Suffers from a few years of neglect

- Nov 2007 we paid 24.2 million for the Castleridge location. Concrete took $3.2 million as their fee.

- The June 2008 appraisal was $18.5 million; the June 2010 appraisal $18.2 million

- Loss in value of $5.7 million. Why? Large promotion fee, receivership costs, spike in retail vacancy, 30% vacancy

- Exit of CCAA after 1.5 years in July 21st, 2010

Continue reading Avenue Commercial Castleridge LP Investment Corp. Annual General Meeting Notes

Alberta Securities Commission Notice of Hearing for Dave Jones, Rachael Poffenroth, Varun “Vinny” Aurora, David Humeniuk, and Vincenzo De Palma

I haven’t published anything lately about Concrete Equities or Wealthstreet, but things are continuing to evolve with those companies and the people who ran them. Late last year, a notice of hearing (or possibly two?) was held for Dave Jones (A.K.A. Colin David Jones), Rachael Poffenroth, Varun “Vinny” Aurora, David (Dave) Humeniuk, and Vincenzo De Palma. When we were clients of Wealthstreet, Ms. Poffenroth was the president of the company.

To any lawyer reading this: no statement made in this post can be considered libel; I am simply re-publishing publicly available information. I make no allegations myself, and all data provided is from public sources.

The two PDF documents below have the details, but allow me to quote two sections from the second PDF:

Allegations: Summary of Breaches (Page 3)

“1. Staff of the Commission (Staff) allege that Varun Vinny Aurora (Aurora), David Humeniuk (Humeniuk), David Jones (Jones) and Vincenzo De Palma (De Palma) breached the Act by acting as dealers without being registered in accordance with Alberta securities laws, and without an applicable exemption to the registration requirement, or by authorizing, permitting or acquiescing in such conduct by one or more corporate entities of which they were a director or officer.

The Impact of the Respondents’ Actions (Page 10)

“76. The Offending Partnerships and CE Fund collectively raised approximately $110,000,000, with $96,735,000 raised using the impugned Offering Memoranda referred to above. In total the Concrete Group raised over $118,000,000 through the issuance of securities to 3,723 investors.

77. On May 26, 2009 Partnerships 1 through 5 sought and obtained protection from their creditors through the filing of a Notice of Intention to Make a Proposal under section 50.4(1) of the Bankruptcy and Insolvency Act, R.S.C. 1985, c. B-3 as amended. On June 9, 2009 Ernst & Young Inc. was appointed as Interim Receiver of Partnerships 1-5.

78. On July 29, 2009 Concrete, the Offending Partnerships and each of their general partners were made subject to a Receivership Order (the Receivership Order). Ernst & Young Inc. was appointed Receiver for each entity.

79. Prior to the Receivership Order, the shareholders of the Concrete Group received distributions of slightly under $5,000,000. This represents a payment of only roughly 4% of their investment principal.

80. In contrast, prior to the Receivership Order, Concrete was paid over $15,000,000 in commissions as a result of the various Concrete Agreements. However, under the terms of those Concrete Agreements, Concrete was only entitled to commission payments of $10,107,750. Concrete was overpaid approximately $4.9 million.

81. In addition to the commission payments to Concrete, Aurora, De Palma, Humeniuk and Jones were also collectively paid over $8.0 million as directors of the various Concrete Group entities.

82. In its Third Report of the Receiver, dated December 2, 2009, Ernst & Young Inc, as Receiver, concluded that “based on the information presented in this report it is clear that the directors of Concrete mismanaged the affairs on Concrete in material respects.”

83. It is uncertain what recovery, if any, will be made by the 3,723 investors in the Concrete Group of their collective $118,000,000 investment, and significant further recovery of their investments is questionable.”

The two PDFs are below and can be downloaded, printed, or shared. Continue reading Alberta Securities Commission Notice of Hearing for Dave Jones, Rachael Poffenroth, Varun “Vinny” Aurora, David Humeniuk, and Vincenzo De Palma

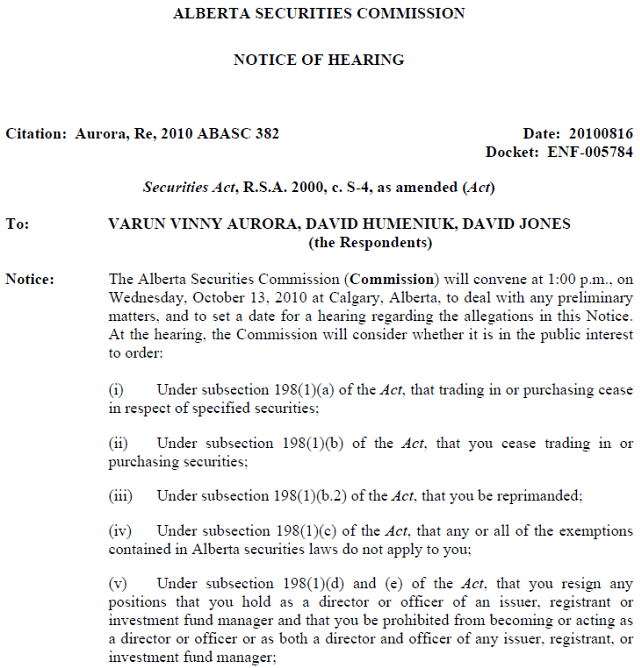

Alberta Securities Commission Notice of Hearing for Varun “Vinny” Aurora, David Humeniuk, and Dave Jones

Wondering what happened to Varun “Vinny” Aurora, David Humeniuk, and Dave Jones? The Alberta Securities Commission has something to say. I quote:

“The Alberta Securities Commission (ASC) has issued a Notice of Hearing alleging Calgary residents Varun Vinny Aurora, David Humeniuk and David Jones breached Alberta securities laws by acting as dealers without being properly registered, making serious omissions and misrepresentations to investors and distributing various Concrete Equities Group entities’ securities using offering documents not in compliance with Alberta securities laws.

The appeatence to set a date for the hearing will be held on October 13th, 2010, at 1 p.m. in the ASC Hearing Room on the 6th Floor, 300 – 5th Avenue S.W., Calgary, Alberta. I’m pondering going myself – I wonder if it’s open to the public? The full notice of hearing document can be found on the ASC Web site, but I’ve also mirrored a copy of it here. Continue reading Alberta Securities Commission Notice of Hearing for Varun “Vinny” Aurora, David Humeniuk, and Dave Jones

Dragon Fund Meeting Scheduled for June 16th

If you’re an investor that has money in the Dragon Fund, the fund originally started by Dave Jones of Wealthstreet, you’ll be interested in knowing that the trustees of the Dragon Fund (of which Dave Jones is no longer one) have called a meeting. I phoned Michael Arnold (one of the trustees) today to ask what the latest updates were on the land in Airdrie, and he said they had been contacting investors via email – and that the email they sent me bounced. The meeting is being held on June 16th, 7pm, at Southside Victory Church (6402 1A Street SW) in Calgary. I’ll be there and will report back what the trustees tell the investors.

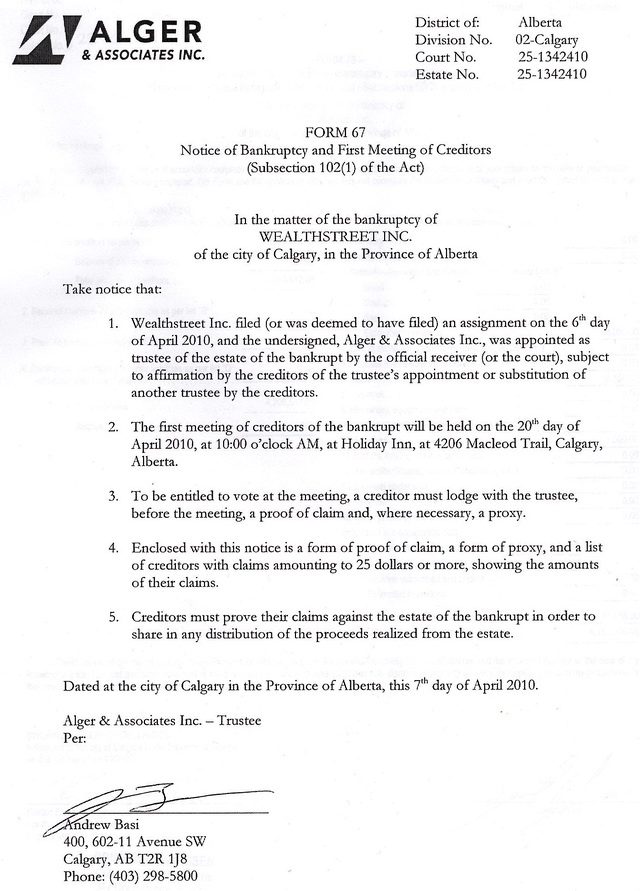

Wondering What Happened to Wealthstreet?

If you’re in the Calgary area and have had any dealings with Wealthstreet or Dave Jones, the President and CEO of Wealthstreet, the above notice of bankruptcy of Wealthstreet Inc. tells you where the company is at now. I get a few emails a month asking me what’s happening with Wealthstreet, and now it’s official. I’m not an accountant, but according to page two of this document, there are $3.2 million in unsecured creditors, $942K in preferred creditors, for total liabilities of $4.2 million dollars. The asset side of the equation shows $40K in accounts receivable, $4.4K in cash, and $1K in furniture. Somehow this company that dealt with millions of dollars in investment money only has assets totaling $45K. Interesting how that worked out, isn’t it?

The sad part of this document is the list of unsecured creditors; there are 136 individuals and companies on that list – most of them individuals – who are owed large sums of money. $50,000…$100,000…one couple is owed $228,167! Entire life savings were wiped out, which I find disheartening. I feel very fortunate that we were able to escape losing virtually nothing directly with Wealthstreet, instead having the bulk of our money locked up in the battle with the now-defunct Concrete Equities – a battle that seems to be nearly won last I heard. I received a copy of this document because apparently we have an unsecured claim with Wealthstreet of $1…despite what the cover letter says about a minimum $25 claim. I certainly never filed any claim with Wealthstreet.

Worth noting is that the single largest unsecured creditor is by Rachel Poffenroth in the amount of $658,874. Why is that worth noting? She was the one-time President of Wealthstreet – she held the position when Ashley and I started dealing with Wealthstreet. Also noteworthy is that the second biggest creditor, this time a preferred creditor, is one Dave Jones, claiming $650,000. Given the corporate assets of $45K, I think they’re both out of luck. It’s a strange world we live in…

A Status Update From Concrete Equities

Although this isn’t relevant to most readers of this blog, I feel it’s important that I chronicle the events that are happening now with Concrete Equities – because it doesn’t look like anyone else has a blog on which they are doing so. My intention isn’t to turn this into a “Concrete Equities Blog”, but since I have a rather large chunk of money invested with these guys, I think you can understand why this issue is important for me to track.

This morning I received an update from the President of Concrete Equities Inc., via email. If you’re an investor with Concrete Equities, please take the time to read through this discussion thread (UPDATE: it has since been deleted, but Google’s cached version has some of the info) – you’ll learn a great deal about your investment and the status of is. That thread is also where they announce meetings of investors. As for this message from the President of Concrete Equities, it’s hard for me to separate fact from fiction. I think the financials will reveal the truth in time. This is a long message – the first section is about the Mexico investment, of which we have a unit in Santa Clara, and the remainder of the email is about the Calgary investments (we have the Castleridge investment).

Dear El Golfo (Santa Clara) Investor,

At this time, our firm would like to update you on current developments on this particular project. El Golfo de Santa Clara region remains viable for future tourist development. Being the first point of beachfront on the Sea of Cortez along the coastal highway in the state of Sonora it is developing into a great drive-to destination for Americans. When the project began, the coastal highway was under construction and the international airport was being conceptualized. Since that time the coastal highway is near completion and the international airport to service El Golfo de Santa Clara and the Puerto Puenasco (Rockypoint) area is well underway. Also please keep in mind that your investment is a solid, equity based land hold with no mortgage or debt position on your asset. Continue reading A Status Update From Concrete Equities