UPDATE OCTOBER 26th 2009: As of a couple of weeks ago, Wealthsteet’s phone number has been disconnected and the company is apparently out of business. I have no information about how to get in touch with Dave Jones, nor what this means for investments on the Wealthstreet Dragon Fund, a fund operated by Dave Jones. This blog entry has a comment that seems to indicate the Dragon Fund may still be intact, but I don’t know whom to contact to get further information. Some further updates on this can be found here.

UPDATE: This blog post was originally written in February of 2007. At the time I was quite impressed with WealthStreet and Concrete Equities. Now, as of May of 2009, I’m very concerned for my Concrete Equities investment after reading this forum thread. I certainly don’t believe everything I read online, but there are enough red flags to warrant significant concern. Most concerning of all to me is that Dave Jones has recently stepped into the role of CEO at Concrete Equities. How can I expect fair and impartial advice from Wealthstreet regarding my investment in Concrete Equities if the same man is running both? I can’t, and that’s very troubling to me. My “Wealth Coach” at Wealthstreet no longer works there, and no communication was sent out to his clients informing them that he was leaving. I had to call Wealthstreet and find this out when I asked for him and was informed he no longer works there. I would advise extreme caution regarding getting involved with Wealthstreet at this time.

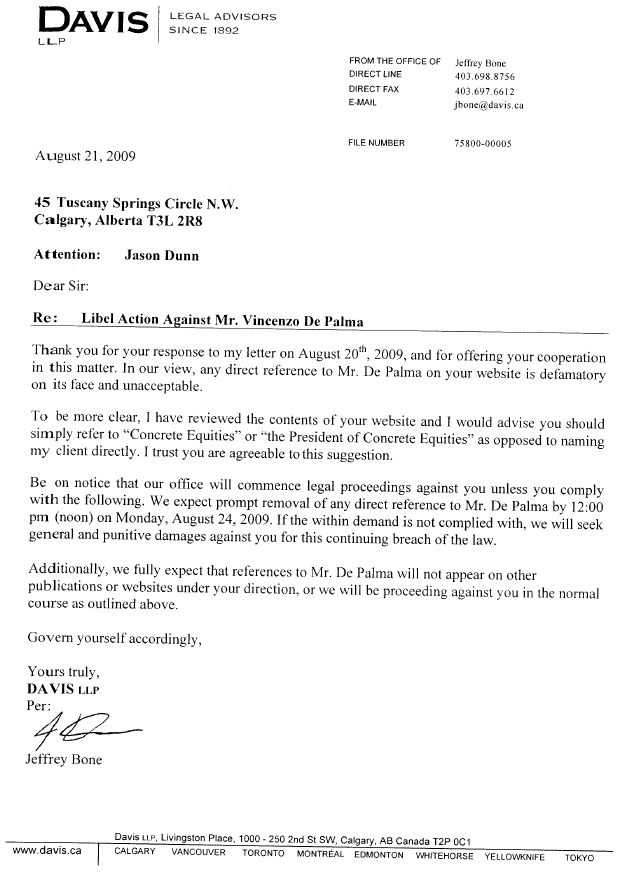

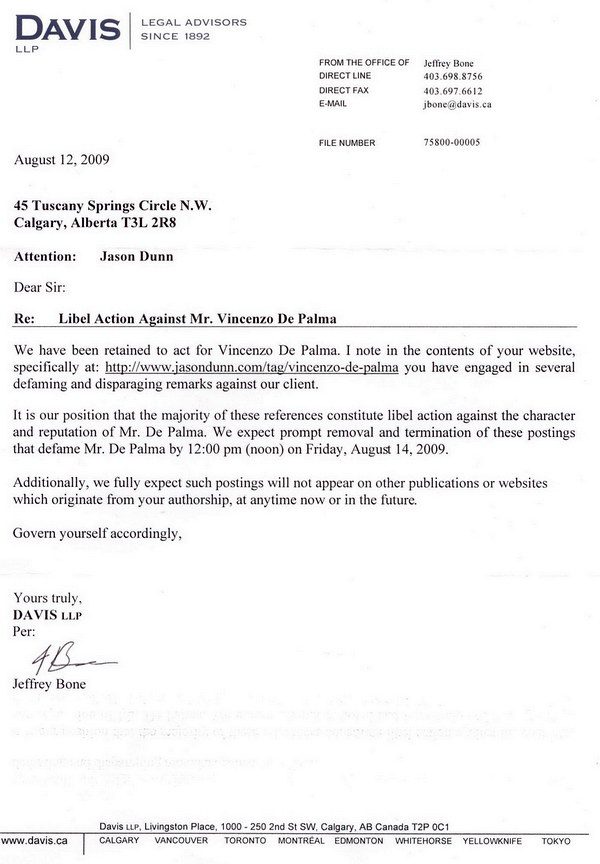

UPDATE #2 (August 20th, 2009): The forum thread at Canadian Business I linked to above is no longer valid. It has been deleted, and my post in those forums asking why the thread was deleted, was itself deleted. This is called “a clean up” – someone is trying to erase all traces of this issue online. Lawyers and accusations of libel are involved. Thankfully, you can still get some of the discussion via Google’s cached version.

On Saturday, February the 3rd, I spent six hours in a investment seminar put on by Wealthstreet, a Calgary company that I’d been hearing about for years and meaning to get in touch with. I’m better than most with finances, but I have a firm belief that you should do what you’re good at and avoid what you’re not good at – and for me, that means seeking advice from people who do this for a living. I bought stocks all of one time in my life, and I lost money on it.

We’ve done some work with World Financial Group (WFG), but over the past year I’ve become increasingly disillusioned with them. Our consultants are the nicest guys in the world, but niceness does not a balanced portfolio make. The WFG plan had us sink 100% of our money into a single mutual fund, and after a few months I gave my head a shake and realized how exposed we were because we had almost no diversification (Enron stock holders unstand this now). I took some steps to correct that, but ultimately things still aren’t right – and that’s why I found this Wealthstreet seminar so fascinating. I’m indebted to my parents for inviting Ashley and I to attend this with them – it was a real eye-opener. After the first half was over I made an appointment to meet with a Wealthstreet advisor to re-work our portfolio (meagre though it may be).

I’m publishing my seminar notes for two reasons: first, so that people searching for Wealthstreet can find this blog post and see my positive experience with their seminar. Secondly, even for those people reading this blog that live outside Calgary (which is most of you), I think you’ll find many of the basic financial concepts to be sound no matter where you are in the world. It’s certainly worth thinking about your financial future no matter how young you are, and simply shoving all your money into RRSPs (or 401K’s if you’re in the USA) isn’t a good long-term solution.

I’ll make one caveat about my notes: they might not be 100% accurate, so don’t take them as such. There was a great deal of information, and I may have gotten some of it wrong. Besides, what kind of a person takes financial advice from a blog? 😉

Dave Jones, Wealthstreet CEO

- Family is important, the allocation of time should be focused 99% on everything else in your life, 1% on focusing on your investments

- “You don’t get a mulligan when it comes to your retirement.”

- You should have four to seven income streams in order to retire

- 40% of Canadians have made an average of three withdrawls from their RRSPs

- IBM sold to Lenovo because they couldn’t afford the pension for their own people

- Pension Crisis is looming: too many people retiring, not enough growth in the funds to compensate for the amount of draw from pensioners

- Bullet Proof 50% of your portfolio, Growth & Income 40% of your portfolio, 10% speculation

If you speculate with 10% of your portfolio, and only 5% performs, it might out-perform the rest of your portfolio

- Your house an as asset must be put to work – you can’t eat a doorknob

- 1 in 7 Albertans will be the victim or attempted victim of mortgage fraud

- House rich, cash poor: people who own a house worth a great deal, but they can’t afford the property taxes

- Personal savings as a percentage of disposable personal income is -5%. Someone who earns 100K a year is spending 105K

- 10% of the world owns 90% of the assets…Trump and Kiyosaki worry that 1% of the world will eventually own 99% of the assets Continue reading WARNING: Wealthstreet Investment Seminar