Quotable Quotes: George Bernard Shaw

“The reasonable man adapts himself to the world: the unreasonable one persists to adapt the world to himself. Therefore all progress depends on the unreasonable man.”

— George Bernard Shaw

That quote makes me feel better about being someone who constantly agitates for change and seeks to improve things…some people consider me unreasonable at times. 🙂

Marvel at Creation

via The Simplicity Post

The Groupon/Coupon Bubble Will Burst Soon

I posted the above status update earlier today, and when asked to explain myself on Facebook, I wrote up a rather lengthy explanation that seemed worth of turning into a blog post…so here it is (slightly edited for clarity).

I’ve talked to a few small businesses now that have used these new coupon services, and in every case so far, they’ve been financially maimed by them. Some due to their own ignorance or poor financial understanding, some by the salespeople at the deal companies.

A carpet cleaning company used Kijiji and the salespeople wouldn’t allow him to put a limit on the number of coupons sold – because they wanted to gain as much revenue as possible from it of course. They charge 50%, like everyone seems to, and still tacked on another 2.5% in credit card processing fees. Talk about adding insult to injury. Thankfully for him, only 150 people ordered the carpet cleaning – he was smart enough to spread out the appointments, only booking the Kijiji deals three times a week. That makes it frustrating for customers like me to get the service in a timely fashion – it took two months for me to get my booking in – but given that he’s working at 77.5% off his normal price, he’s only breaking even on supplies and travel costs…so his labour is free. Hard to feed a family on that!

In my case he made some money – I had him do two sets of stairs, which weren’t a part of the deal – but he said nearly every time people only want what the coupon covers. So as soon as he hits 500 square feet of carpet cleaned, he stopped.

Most businesses hope for repeat customers, but the type of customers that use deals like these are usually the kind who aren’t willing to pay for a service at full price in the first place. So you end up with people using your service at no profit to you, and you don’t get many new customers out of the deal. There are some exceptions: the guy that did our carpets did such an amazing job I’ll absolutely use him again, paying full price and b happy about it. I think that’s rare though.

Some deals can scale, no matter how many coupons are sold. I just bought a $10 for $20 at Old Navy for example. Old Navy could sell 10,000 of them and their stores could handle the extra traffic just fine. But the small carpet cleaning business, if he suddenly has 500% more clients than before, it soaks up all his excess capacity (good) but also uses up all his future capacity for the next six months (bad), at no profit. I heard of a cleaning company that went bankrupt because they sold too many coupons – again, because the company wouldn’t let them restrict the number of coupons sold – and it was easier to go bankrupt than to absorb the losses of the poor business decision of using the coupon service.

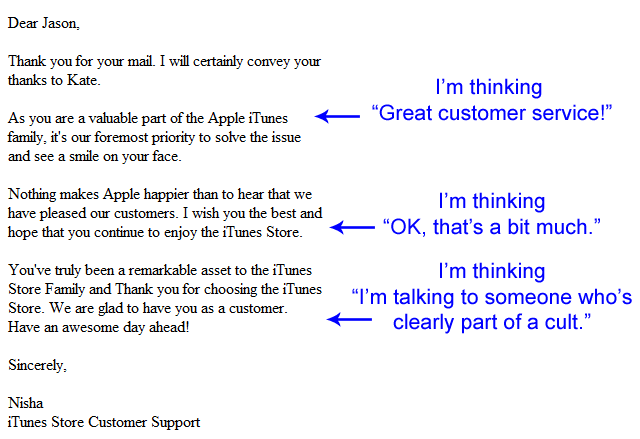

Apple Customer Service

A Case of Curious Parking, Curb Your Enthusiasm Style

I don’t know if this is going to be a controversial post or not, but having watched a lot of Curb Your Enthusiasm lately, this odd scenario jumped out at me as if Larry David himself wrote it and I thought it was amusing enough to share.

I was at the Avenue Commercial shareholder’s meeting last week, and I pulled into the parking lot looking for a spot. I was baffled seeing a car parked in front of two spots, completely blocking access to both of them. It was like this person simply didn’t want the hassle of turning their wheel and it was easier to drive straight into the parking lot and stop the car in that spot. I managed to just barley fit into the third spot, and when I got out I was surpried to see a blue handicapped card hanging from the rear view mirror.

I thought to myself “That card gives you the ability to park in special spots near the door, so why pick the middle of the parking lot to stop your car and get out?” I have to wonder how this person justified blocking two parking spots? Perhaps I’m being unfair and there was a reason for this, but for the life of me I can’t think of what it could be. The ultimate irony in all this? On my way to the door I walked past a handicapped parking spot with no one parked in it.

If this really were a Curb Your Enthusiam episode, it would have gone something like this…

Larry David is in a rush and pulls into a parking lot, looking for a parking spot. The only spot available is the handicapped spot, so Larry pulls into it (and it’s a “straight shot spot” where you can pull in coming off the street without needing to turn the wheel), justifying it by saying no handicapped person needs that spot at that very moment. He tells himself he’ll be quick. After his appointment, Larry comes out of the building to find a handicapped woman in a vehicle waiting for him, angry that Larry had taken the spot. Larry gets into a verbal sparring match with this woman, and she yells that she needs the use of this “straight shot spot” because she can’t manoeuvre her full-sized van with a wheelchair ramp into any other spot in the lot. Larry yells back that if this she can’t park in any spot but this one, she should just pull into the lot and park perpendicular to other vehicles. He insists that he would be totally OK with her doing this. Discussions with Jeff would later ensue about the “Straight Shot Spot”, and Larry would find himself shortly in a situation where, upon his suggestion, the same woman would have parked perpendicular to his vehicle in a different parking lot, blocking him in his spot and causing him problems. Or something like that. 😉

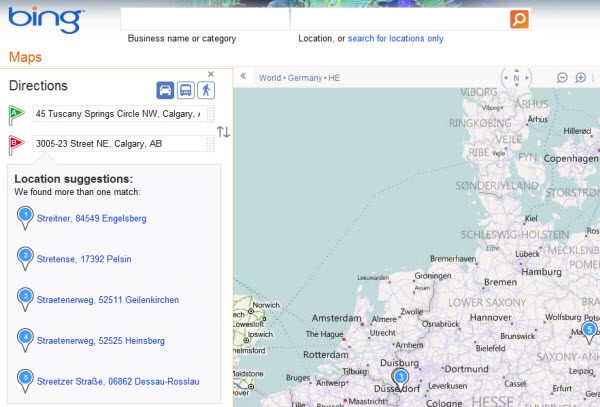

Bing: Getting Better, But Room for Improvement

I don’t know about you, but I’ve been using Bing more and more lately – and for the most part, I’ve come away quite impressed with the search results I’m getting. I’m starting to see results that are even better than Google in some ways, which is excellent – Google allowed their index to become infested with spammy results. One area that Bing needs big improvement in though is maps – Google has a strong lead there in my opinion. The screen shot below is a perfect example of how Bing struggles to give proper directions:

Both of those addresses are in Calgary, yet look at where Bing thinks the destination is…Europe! How it can get delivered the keywords of Calgary and AB (Alberta) and get Europe is beyond me. Time to tweak that code Microsoft!

Performance Matters in Email Newsletters Too

The above screenshot is from a newsletter that I received today, and it’s pretty normal for me to see broken images in a newsletter, or images that take so long to download, they might as well be broken. We live in a world where there are all sorts of tools and services to monitor the up-time and performance of a Web site, and yet little to no attention gets paid to the up-time and performance of email newsletters. When I get an email about a sale at a big box retail store and the images in the newsletter take 60 seconds to load, that doesn’t make me think very highly of the brand in question. If you have an email newsletter, do yourself a favour and make sure it delivers the kind of experience you want your customers to have.

And in case anyone is wondering, the images were still broken after I gave Outlook permission to download the images…

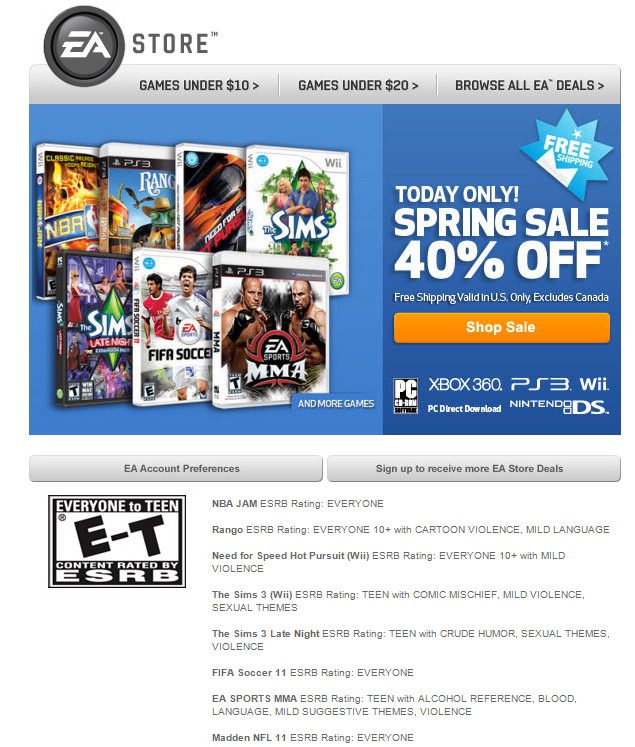

All or Nothing Email Marketing Creates Brand Resentment

Let’s talk about marketing to your customers for a minute. Let’s me use myself as an example: at the moment, I regularly play one Xbox 360 game (Borderlands) and one Windows game (Dragon Age). I just bought Dragon Age 2 recently. When I purchased Dragon Age in late 2009, I needed to register an account. As part of that registration process, I wanted to be alerted to new things related to Dragon Age. Not all games, only the game franchise I was a fan of. Electronic Arts (EA) makes the classic mistake many marketing departments make: treating all their customers the same and assuming that all customers want to know about every game. Continue reading All or Nothing Email Marketing Creates Brand Resentment

Avenue Commercial Castleridge LP Investment Corp. Annual General Meeting Notes

Today I attended the Avenue Commercial Castleridge LP Investment Corp. Annual General Meeting and finally learned about the status of our troubled Concrete Equities investment. There’s some bad news, and some good news. Overall though, it was net-positive: the bottom line is that there’s some debt to deal with (the vultures want their pound of flesh), but we have full ownership of our property, are cash-flow positive, and things are looking up in terms of us eventually getting back on track for the cash disbursements we all signed up for. I took as many notes as I could; here they are in point form:

- Presented by Steven Butt, General Partner, Avenue Commercial

- Very positive on this particular building

- They were given millions of pages of documents by Ernst & Young; hard drives. Five months of work to process, several hundreds of thousands of pages scanned

- They’re not going to go back and look at all the documents – they’re moving forward

- We now have financial statements (hooray!)

- T-5013 tax forms are available

- Castleridge: 8.25 acres of property, 74,000 square feet of leasable space

- Building constructed in 19991 and in good condition, but the overall property needs some work. Suffers from a few years of neglect

- Nov 2007 we paid 24.2 million for the Castleridge location. Concrete took $3.2 million as their fee.

- The June 2008 appraisal was $18.5 million; the June 2010 appraisal $18.2 million

- Loss in value of $5.7 million. Why? Large promotion fee, receivership costs, spike in retail vacancy, 30% vacancy

- Exit of CCAA after 1.5 years in July 21st, 2010

Continue reading Avenue Commercial Castleridge LP Investment Corp. Annual General Meeting Notes