I knew the ESPN partnership was firing up in 2019, but I didn’t quite grasp the extent of it…that the UFC would completely destroy the value of being a Fight Pass subscriber if you only watch UFC content and live in the USA (as I do). I don’t have cable TV, don’t watch UFC PPV fights live (too much $$$), and completely rely on UFC Fight Pass to watch 100% of my UFC content. So imagine my shock when I went to watch new fights and everything is blacked out and only available on ESPN+. There’s no reason for me to remain as a UFC Fight Pass subscriber from what I can see so far. Anyone else feel the same? My thoughts so far on the ESPN+ experience replacing UFC Fight Pass are below – I’d love to hear from others here how they are finding it. I used the service for five days before writing this.

The Good

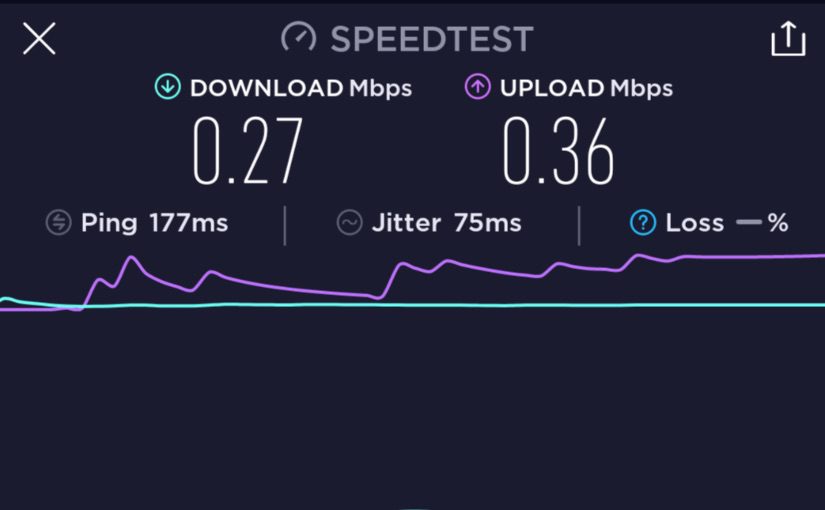

The video quality of fights on ESPN+ is superior to UFC Fight Pass – it looks like it’s 1080p and at a much higher bit rate. I’ve always been irked at the crappy 720p quality of UFC Fight Pass, so I’m thrilled to see better quality on ESPN+. This is a big plus. And, well, that’s about the only good thing I found about it so far.

The Bad

The biggest negative I’m finding so far is while the UFC Fight Pass app was laid out logically – I’d always go into the UFC section > replays and find the event I hadn’t yet watched – the ESPN+ app is, by comparison, an ugly mess. I don’t care about other sports, so it takes some digging to get into the MMA section. That’s not a big deal – the big deal is that once you are into the MMA section, there’s just a long horizontal scroll of UFC content mixed together. About one third of it is Ariel Helwani shows, which I don’t care about (no offense Ariel).Taking a “dumping ground” approach to organizing UFC content is absolutely the wrong approach. It’s messy, it’s confusing, and the fact that they don’t use even show the name of the event makes it so much worse. In order to find the event I hadn’t watched yet, I had to go into UFC Fight Pass, find the event name and date, then go into the ESPN+ app and find the “Sat 2/2 UFC Fight Night Prelims” event. ESPN needs to work with an information taxonomy specialist because this is a dumpster fire right now.

I’ve never seen cameras lose focus though during a UFC fight, but three times during the first Feb 2nd prelim event the shot went completely blurry – did ESPN hire interns to shoot this? Lots of amateurish video production as well – weird fades to black, goofy cuts, etc.

I was surprised to see an ad during the round break, and a bunch of ads before the decision – I guess even though we’re paying for ESPN+ it’s still mostly ad-supported? If I’m paying for something I don’t like see ads, but at least they can be skipped. There are a LOT of ads though – I’m unclear what I’m paying for, honestly, with this many ads.

The Ugly

It doesn’t look like UFC PPV events will ever be viewable for free on this service. I’ve been searching for a firm answer on this, and couldn’t find one so reached out to ESPN+ support and this was their answer: “We don’t know what the future will hold, at this time there are no plans for this”. So it’s looking like the new owners of the UFC have decided that they are going to squeeze fans for more $$$ to watch these events.

The ESPN+ app is extremely buggy and unstable on Apple TV. On the Apple TV, once you pause it pressing play/pause won’t unpause the video – you have to back out (via the Menu button) and go back in to watch it. The more I use this app the more bugs I find. At one point the fight audio was playing while the video was a grey blur – I had to kill the entire app do to anything. It also doesn’t do progress tracking as you watch; after I killed the app when I went back into the fight it started over from scratch.

There’s another bug where, after pausing, pressing menu and going back into the fight, the play/pause button no longer works – neither does the menu button or the dpad, so you can’t skip commercials. The only way get out is to kill the app. The ESPN+ software QA team is not doing their job – I haven’t seen a commercially released app this bad in years.

The Bottom Line

This is a huge step backward for anyone who was a UFC Fight Pass subscriber. The UFC has delivered a huge eye-poke into the eyes of UFC fans who relied upon UFC Fight Pass to watch UFC content. Maybe someday ESPN+ will mature into a suitable replacement, but it’s certainly not that today. For the first time ever, people outside the USA will have much better content and access to UFC content via UFC Fight Pass (for now).