I didn’t grow up with gig economy delivery services, so what might seem normal to some in 2024 seems absolutely insane to me: paying a ridiculous price for convenience.

How much of a price? I had an opportunity to do a direct comparison on the same order from Five Guys (who make tasty burgers and fries) because I happened to have a $50 DoorDash gift card. It was my first time using the service, and likely the last barring injury or some other blocker to me going to get food directly.

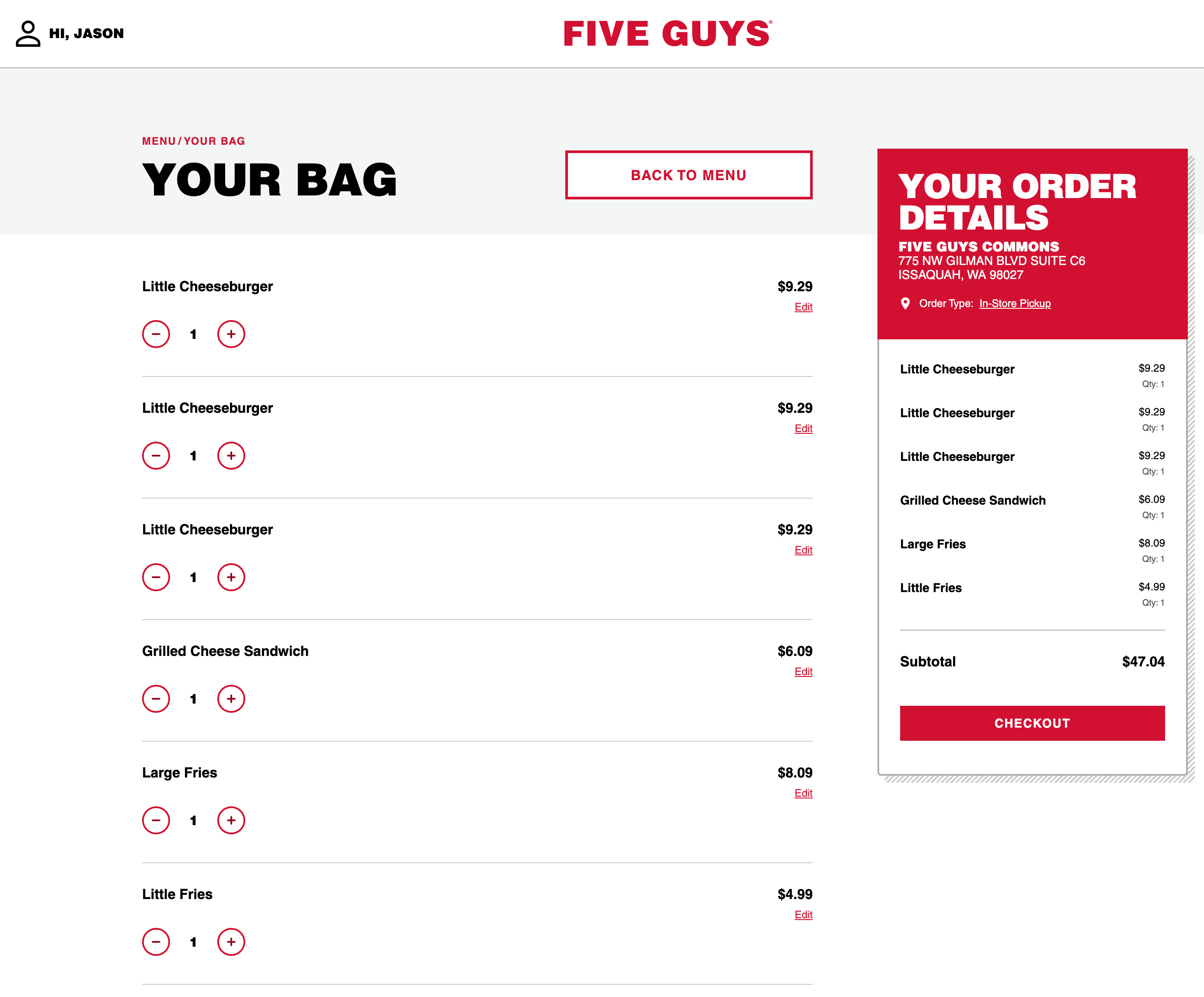

Three cheeseburgers, one grilled cheese sandwich, and two large fries: a meal to feed my family of four. $47.04, with tax ($4.78) and a 20% tip ($9.29), that’s a total of $60.52. Now let’s look at the same order with DoorDash…

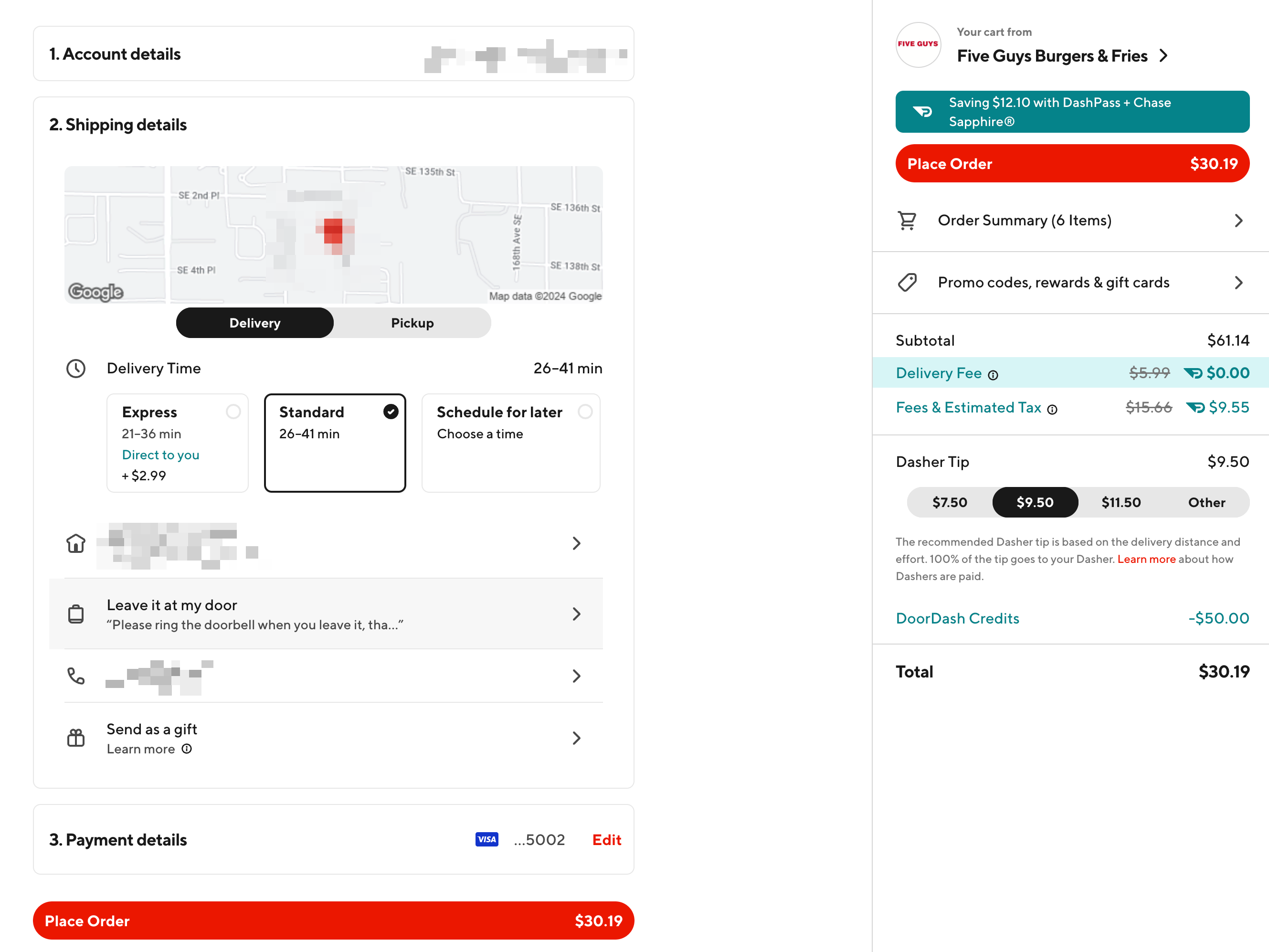

This is a bit convoluted because of fees and credits, but here’s how it breaks down:

- $61.14 for the food. This is 30% more expensive than ordering directly 💸

- Because I am a Chase Sapphire credit card holder, the $12.10 delivery fee was waived, but let’s assume that most people ordering don’t hold this particular credit card, so add the $12.10 fee 😕

- What makes up the “Fees & Estimated Tax” of $9.55? The state tax should be $4.78, so there’s an additional $4.77 for…something 🤔

- My $50 gift card makes the order $30.10, but without it we’re looking at $80.19, which is 33% more than ordering from Five Guys directly 💰

- If you were to pay the $12.10 DoorDash fee, it’s 52% more expensive than ordering direct 😲

Everyone’s time is worth something, and ultimately the use of money is about saving time. If you have the ability to pick up food from a local restaurant (which I know is not the case for everyone), you need to ask yourself if your time is worth paying 52% more for the same end product. If someone’s being rational, the answer is no, it’s most definitely not.

Eating out is expensive enough, but delivery services such as DoorDash and Uber Eats make it even more so. Save money, give the restaurant more profit per order, and go pick up your food yourself. And hey, it will probably be fresher as well!